- HGV Tax Bands – or VED bands

- HGV Road Tax Calculator

- What is the HGV Road User Levy?

- Legal obligations

- Frequently Asked Questions

HGV road tax is a category of an annual tax levied by the British Government. It must be paid for most powered vehicles that are to be used or parked on public roads in the UK. It is officially known as Vehicle Excise Duty (VED).

Taxation for the use of HGVs on UK roads is based on the size and weight of a vehicle (as specified on a vehicle’s weight plate), and the number of axles a vehicle has. The level of road tax that you will pay for your HGV also depends on your vehicle’s tax band and whether it has road friendly suspension.

HGV road tax applies to lorries that weigh more than 3.5 tonnes when loaded and can be bought every 6 months or annually.

HGV Tax Bands – or VED bands

In short, HGV Tax Bands are complicated! However if you know your vehicles’ weight, the number of axles and whether it has road friendly suspension you will be able to work out which tax band your vehicle belongs to and subsequently how much road tax or VED you need to pay.

There are different HGV tax bands for articulated vehicles and rigid vehicles that don’t pull a trailer and those that do pull a trailer. In addition, there are many sub-categories where a vehicle weight exceeds 12,000kgs.

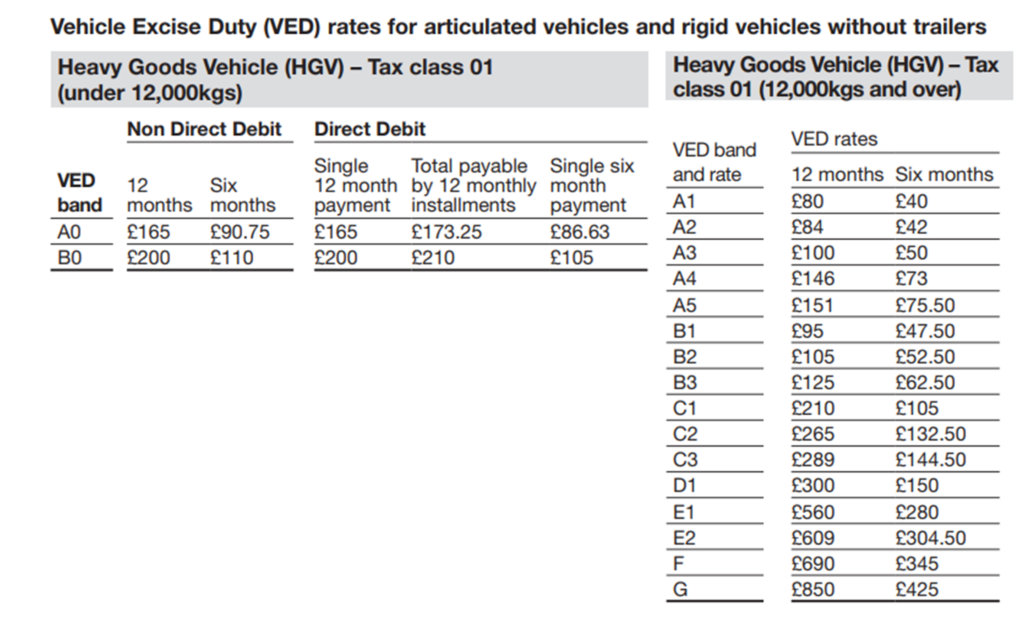

The table below is taken from the DVLA “Rates of Vehicle Tax” document and shows VED rates for articulated vehicles and rigid vehicles without trailers in Tax Class 01. HGVs are also subject to Tax Class 02 (where a trailer is pulled).

The VED band that applies to a vehicle is determined by its engine size and emissions rating. Essentially this means that the cleaner the engine, the cheaper the road tax. This is illustrated in the table below.

The full document containing all tax bands that are applicable to HGVs can be found here: (information correct at time of publishing).

HGV Road Tax Calculator

As previously mentioned, when it comes to determining the appropriate level of road tax, there are many different classes and VED bands and rates. The UK Government has developed a useful online road tax calculator.

If you need to calculate your car or light vehicle tax please visit www.gov.uk/calculate-vehicle-tax-rates or for further information about taxing your vehicle visit www.gov.uk/vehicle-tax.

In addition to HGV road tax, many vehicles are also required to pay an HGV Road Levy.

What is the HGV Road User Levy?

The HGV Road User Levy is a time-based charge of up to £1000 a year or £10 a day for all vehicles over 12 tonnes in weight that use the UK’s road network. It is a system that rewards better efficiency and environmental performance.

The levy was first introduced on the 1st April 2014. It has been updated following further consultations, and since February 2019 less polluting vehicles have paid a lower levy. The newest lorries generate 80% less nitrogen oxide (NOx) emissions than older ones.

As such, lorries that meet the latest Euro VI emissions standards are now eligible for a 10% reduction in the cost of the HGV levy. Euro Class V and older vehicles must pay up to 20% more.

Developed as a means of bringing in money from HGV operators to contribute to the cost of building and maintaining the UK road network, HGV Road Levy is calculated by a vehicle’s:

- weight

- axle configuration

- engine emissions, and

- levy duration

Due to the global COVID-19 pandemic, the HGV levy was suspended on 1st August 2020 however it came back in to force at the end of July 2022. This action was introduced to support the haulage sector and to aid pandemic recovery efforts.

It is a well known fact that well maintained vehicles run more efficiently. Emissions are checked as part of vehicle service plans and MOT tests. You must ensure that your vehicle has a valid MOT certificate.

Find out more information about MOT checks here. Whilst MHF (UK) Ltd do not carry out MOT checks ourself, you can find a list of authorised testing facilities here.

For UK registered vehicles, the HGV road levy is collected via the DVLA. Non UK-registered vehicles can also now pay the HGV road levy via the DVLA. Please note that the levy must be paid before the vehicle enters the UK.

For further information about the HGV Road User Levy, click here.

Legal obligations

It is an offence to use or park your HGV on public roads in the UK if it does not have road tax. As an HGV owner or operator you are legally obliged to ensure that your vehicle/s are taxed correctly and that you have paid the HGV Road User Levy where appropriate.

HGV road tax can be applied for at any Post Office that processes vehicle tax. You will need to complete form V85 and apply in person. You will also need to show the vehicle log book (form V5C).

Frequently Asked Questions

Is road tax the same as the HGV Levy?

No, the two are separate. Most vehicles that are driven on UK roads must pay road tax or Vehicle Excise Duty. In addition, vehicles weighing over 12 tonnes that are to be driven on UK roads must also pay the HGV levy. This applies to both HGVs registered in the UK and non-UK registered HGVs.

How do I work out what HGV Levy I need to pay?

Further information about how to use the HGV Levy service is available from the Department for Transport.

My HGV is zero emission. Do I still need to pay the HGV Levy?

No, your vehicle is exempt from paying the HGV levy if it is zero emission. Further information is available here.

References

1. Government notes about vehicle tax classes

2. HGV Weight Plates Explained

4. HGV Road User Levy – for UK registered HGVs